Managing the financial health of a business can be daunting, but understanding financial statements is crucial for any business owner. Financial statements provide a snapshot of your company’s performance, helping you make informed decisions. This Financial Statement Cheat Sheet offers 10 essential tips to help you navigate and understand your financial statements effectively.

Financial Statement Cheat Sheet: Understand the Basic Components

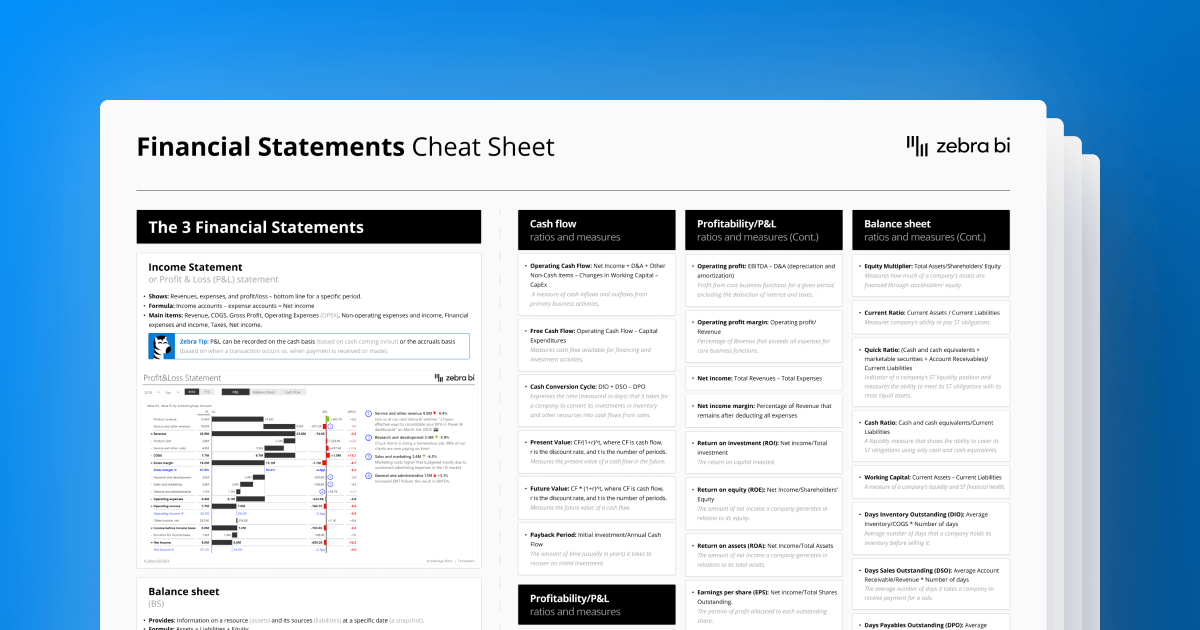

The first step in mastering financial statements is to understand their basic components: the balance sheet, income statement, and cash flow statement.

- Balance Sheet: Shows your company’s assets, liabilities, and equity at a specific point in time.

- Income Statement: Also known as the profit and loss statement, it details revenues and expenses over a period, showing your net profit or loss.

- Cash Flow Statement: Tracks the flow of cash in and out of your business, indicating how well you manage cash to fund operations and growth.

Financial Statement Cheat Sheet: Pay Attention to Key Ratios

Financial ratios derived from financial statements are critical indicators of your business’s health. Important ratios include:

- Current Ratio: Current assets divided by current liabilities; measures liquidity.

- Gross Profit Margin: Gross profit divided by revenue; indicates profitability.

- DebttoEquity Ratio: Total liabilities divided by shareholders’ equity; assesses financial leverage.

Regularly calculating these ratios helps you understand your business’s performance relative to industry standards.

Financial Statement Cheat Sheet: Monitor Cash Flow Closely

Cash flow is the lifeblood of any business. A profitable business can still fail if it doesn’t manage cash flow properly. Your cash flow statement should be regularly reviewed to ensure you have sufficient cash to cover operational needs and unexpected expenses.

Financial Statement Cheat Sheet: Reconcile Accounts Regularly

Regular reconciliation of your accounts ensures the accuracy of your financial statements. Compare your internal records with bank statements, supplier invoices, and customer receipts. This practice helps identify discrepancies early and keeps your financial data accurate.

Understand Accrual vs. Cash Accounting

Your financial statements will look different depending on whether you use accrual or cash accounting.

- Cash Accounting: Transactions are recorded when cash changes hands.

- Accrual Accounting: Transactions are recorded when they are earned or incurred, regardless of when cash is received or paid.

Most businesses use accrual accounting as it provides a more accurate picture of financial health by matching revenues with expenses incurred to generate them.

Review Financial Statements Regularly

Regularly reviewing your financial statements is essential for staying informed about your business’s financial health. Monthly reviews can help you spot trends, address issues early, and make informed decisions. Consider scheduling quarterly reviews with a financial advisor for a deeper analysis.

Use Financial Software

Investing in financial software can simplify the management of your financial statements. Tools like QuickBooks, Xero, or FreshBooks can automate data entry, generate reports, and help with reconciliations. This reduces errors and saves time, allowing you to focus more on strategic planning.

Financial Statement Cheat Sheet:Get Familiar with Key Financial Terms

Understanding financial terminology is crucial. Some key terms include:

- Revenue: The total income generated from normal business operations.

- Expenses: The costs incurred to generate revenue.

- Net Income: The profit remaining after all expenses are deducted from revenues.

- Assets: Resources owned by the business that have economic value.

- Liabilities: Obligations the business owes to outside parties.

Familiarity with these terms will help you better understand and communicate your financial status.

Consult with Professionals

Even with a good grasp of financial statements, consulting with financial professionals like accountants or financial advisors can provide valuable insights. They can help interpret complex data, advise on tax strategies, and ensure compliance with regulations.

Plan for the Future

Use your financial statements not just to assess past performance but also to plan for the future. Financial forecasting, based on historical data and market trends, can guide your business strategy and decisionmaking. Regularly update your financial plan to reflect current conditions and future goals.

Conclusion

Understanding and managing financial statements is a fundamental skill for any business owner. By mastering the basics, monitoring key ratios, and regularly reviewing your financial data, you can make informed decisions that will help your business thrive. Investing in financial software and consulting with professionals can further enhance your financial management capabilities. Remember, your Financial Statement Cheat Sheet is not just a historical record but a powerful tool for planning and growth.

FAQs

1. What is the difference between the income statement and the balance sheet?

The income statement shows your company’s revenues and expenses over a specific period, indicating profit or loss. The balance sheet, on the other hand, provides a snapshot of your company’s assets, liabilities, and equity at a particular point in time.

2. How often should I review my Financial Statement Cheat Sheet ?

It’s advisable to review your financial statements monthly to stay on top of your financial health. Additionally, quarterly and annual reviews with a financial advisor can provide deeper insights and strategic guidance.

3. What are the key financial ratios I should monitor?

Key ratios to monitor include the current ratio (liquidity), gross profit margin (profitability), and debt to equity ratio (financial leverage). These ratios help assess various aspects of your business’s performance and financial health.

4. Why is cash flow management important?

Cash flow management ensures that your business has enough cash to meet its obligations and avoid insolvency. Proper cash flow management allows for smoother operations, better planning, and the ability to handle unexpected expenses.

5. Should I use cash or accrual accounting?

Accrual accounting is generally recommended as it provides a more accurate picture of your business’s financial health by matching revenues with related expenses. However, smaller businesses and those with simpler transactions might find cash accounting easier to manage. Consulting with an accountant can help determine the best method for your business.