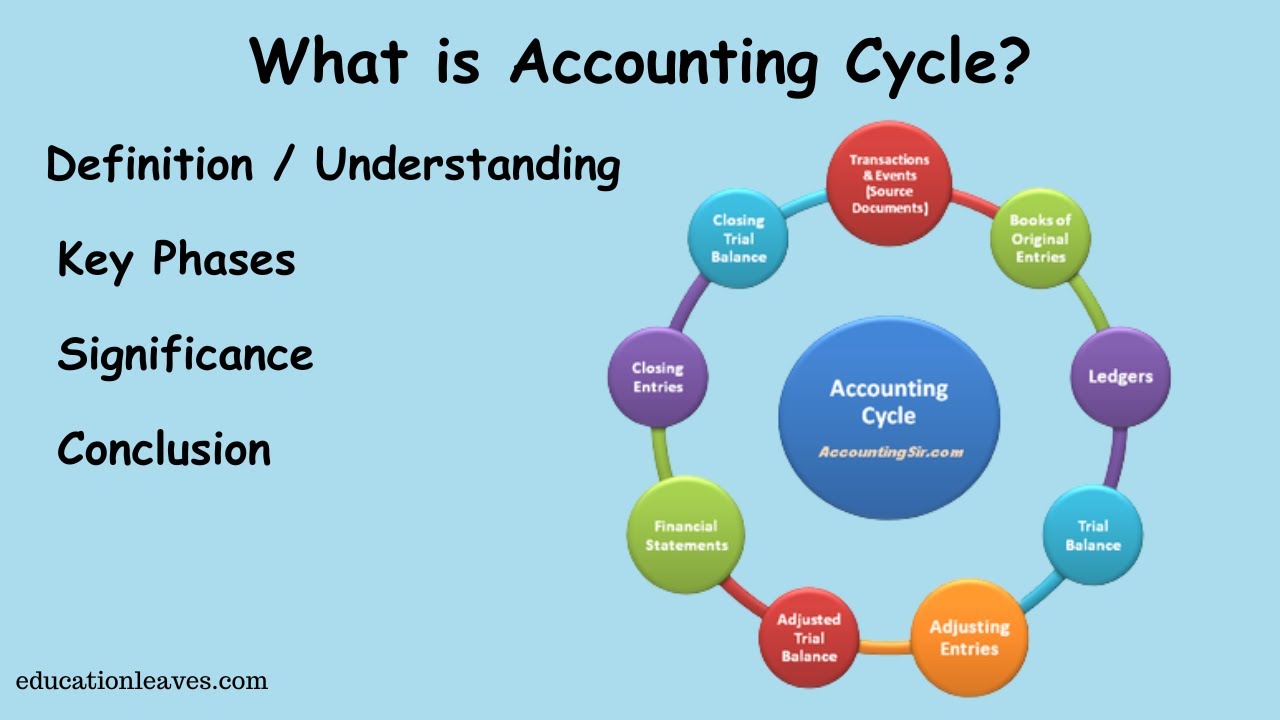

Understanding the accounting cycle definition is fundamental for anyone involved in financial management. The accounting cycle ensures that all financial transactions are recorded accurately and systematically, leading to the preparation of reliable financial statements. In this comprehensive guide, we will explore the 10 essential phases of the accounting cycle, offering a detailed explanation of each step to help you master the process.

Accounting Cycle Definition: Identifying and Analyzing Transactions

The first phase in the accounting cycle definition is the identification and analysis of transactions. This step involves collecting and reviewing all financial transactions that have occurred within a given accounting period. These transactions can include sales, purchases, receipts, and payments. Key points in this phase include collecting source documents such as invoices, receipts, bank statements, and purchase orders. Ensuring that the transactions are relevant and reliable for recording in the accounting system is crucial, as is classifying transactions into appropriate categories such as assets, liabilities, revenues, and expenses.

Accounting Cycle Definition: Recording Transactions in the Journal

Once transactions are identified and analysed, the next step in the accounting cycle is to record them in the journal, a process known as journalizing. The journal is a chronological record of all financial transactions. This phase utilises double-entry accounting, where each transaction affects at least two accounts, maintaining the accounting equation (Assets = Liabilities + Equity). Recording journal entries includes the date, accounts affected, amounts, and a brief description of the transaction. It is essential to ensure that debits equal credits in each journal entry to maintain balance.

Posting to the Ledger

After journalizing, transactions are posted to the ledger, a crucial step in the accounting cycle. The ledger is a collection of accounts that shows the changes made to each account as a result of the transactions recorded in the journal. This involves the general ledger, which contains all the accounts of the business, including assets, liabilities, equity, revenues, and expenses. The posting process transfers information from journal entries to the corresponding ledger accounts and maintains a running balance for each account to reflect the updated totals after each transaction.

Preparing an Unadjusted Trial Balance

The unadjusted trial balance is prepared to ensure that total debits equal total credits after posting transactions to the ledger, an important phase in the accounting cycle definition. This step helps in detecting any errors that may have occurred during the recording and posting processes. It involves creating a list of all accounts and their balances at a specific point in time. Summing the debit and credit balances separately and ensuring they match is crucial. This process also aids in identifying discrepancies that may indicate errors in the journalizing or posting phases.

Adjusting Entries

Adjusting entries are made at the end of the accounting period to account for revenues earned and expenses incurred that have not yet been recorded. These adjustments ensure that the financial statements reflect the true financial position of the business, a key aspect of the accounting cycle. Adjustments include accruals and deferrals for revenues and expenses, recording depreciation expenses for long-term assets, and adjusting for prepaid expenses and unearned revenues to match them with the appropriate accounting period.

Preparing an Adjusted Trial Balance

After making the necessary adjusting entries, an adjusted trial balance is prepared. This trial balance includes all account balances after adjustments and is used to prepare the financial statements, a critical step in the accounting cycle definition. Ensuring all accounts reflect their correct balances after adjustments, verifying that total debits still equal total credits after adjustments, and confirming the accuracy of the adjusted trial balance are essential to proceed to financial statement preparation.

Preparing Financial Statements

The adjusted trial balance serves as the basis for preparing the financial statements, a vital phase in the accounting cycle. These statements provide a summary of the financial performance and position of the business. The income statement summarizes revenues and expenses to determine net income or loss for the period. The balance sheet shows the financial position by listing assets, liabilities, and equity at a specific point in time. The statement of cash flows reports cash inflows and outflows from operating, investing, and financing activities. The statement of changes in equity details changes in owners’ equity over the accounting period.

Closing Entries

At the end of the accounting period, closing entries are made to transfer the balances of temporary accounts (revenues, expenses, and dividends) to permanent accounts (retained earnings or equity), an important step in the accounting cycle definition. This process resets the balances of temporary accounts to zero for the next accounting period. Key points include closing revenue, expense, and dividend accounts, transferring balances to retained earnings or equity accounts, and ensuring temporary accounts have zero balances at the start of the new period.

Preparing a Post-Closing Trial Balance

After closing entries are made, a post-closing trial balance is prepared, a necessary step in the accounting cycle. This trial balance includes only permanent accounts and ensures that total debits still equal total credits. Listing only asset, liability, and equity accounts, verifying the accuracy of the ledger after closing entries, and detecting any errors that may have occurred during the closing process are essential in this phase.

Reversing Entries

Reversing entries are optional and are made at the beginning of the new accounting period to simplify the recording of subsequent transactions. These entries reverse certain adjusting entries made in the previous period, aligning with the accounting cycle definition. Although not mandatory, reversing entries are useful for simplifying future transactions, making it easier to record recurring transactions, and ensuring consistency in the accounting process.

Conclusion

The accounting cycle definition encompasses a systematic process that ensures the accurate recording, classification, and summarization of financial transactions. By following the 10 essential phases—from identifying and analysing transactions to preparing reversing entries—businesses can produce reliable financial statements that reflect their true financial position. Mastering the accounting cycle is crucial for maintaining accurate financial records and making informed business decisions.

FAQs

1. What is the purpose of the accounting cycle definition?

The accounting cycle definition provides a structured approach to recording, classifying, and summarising financial transactions, ensuring accurate and reliable financial statements.

2. Why are adjusting entries necessary in the accounting cycle?

Adjusting entries are necessary in the accounting cycle to ensure that revenues and expenses are recorded in the correct accounting period, reflecting the true financial position of the business.

3. What is the difference between a trial balance and an adjusted trial balance in the accounting cycle?

In the accounting cycle, a trial balance is prepared before adjusting entries to check the accuracy of recorded transactions, while an adjusted trial balance includes adjustments to reflect accurate account balances for financial statement preparation.

4. How do closing entries affect the accounting cycle definition?

Closing entries transfer the balances of temporary accounts to permanent accounts, resetting the temporary accounts to zero for the next accounting period, which is a crucial step in the accounting cycle definition.

5. Are reversing entries mandatory in the accounting cycle?

Reversing entries are optional in the accounting cycle but can simplify the recording of subsequent transactions by reversing certain adjusting entries from the previous period.

Also read: INTERIM CFO SERVICES: 9 STRATEGIES FOR NAVIGATING FINANCIAL CHALLENGES