The IRS Form 8995, also known as the Qualified Business Income Deduction (QBID) Simplified Computation form, plays a crucial role in enabling eligible taxpayers to claim deductions on their qualified business income. However, ensuring compliance and avoiding penalties can be challenging due to the complexities of tax laws. This comprehensive guide will provide you with 10 essential tips to ensure compliance and avoid penalties when filing the 8995 Form.

Understand the Purpose of 8995 Form

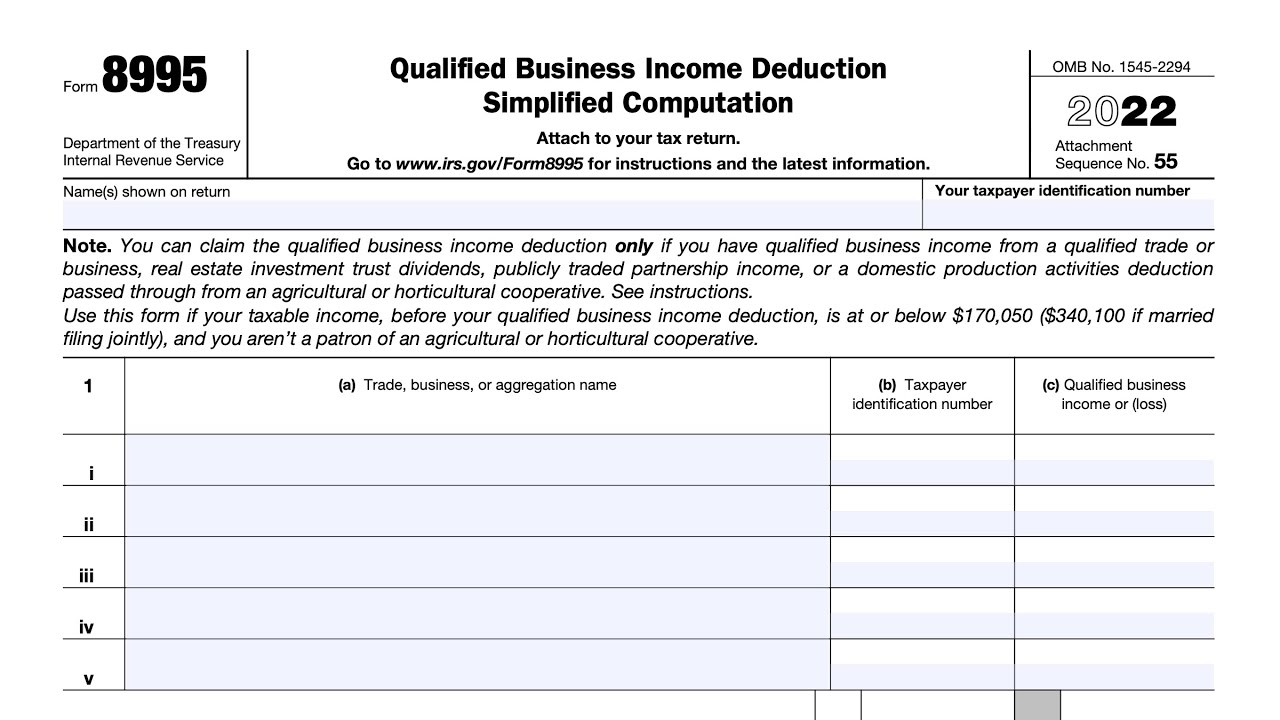

Before diving into the intricacies of Form 8995, it is essential to understand its purpose. Form 8995 is used to calculate and report the Qualified Business Income Deduction (QBI) under Section 199A. This deduction allows eligible taxpayers, including individuals, estates, and trusts, to deduct up to 20% of their qualified business income, thus reducing their taxable income.

8995 Form:Determine Your Eligibility

Not everyone qualifies for the QBI deduction. To be eligible, your income must come from a qualified trade or business. These typically include sole proprietorships, partnerships, S corporations, and certain trusts and estates. Additionally, your taxable income must be below certain thresholds, which are adjusted annually. For 2023, the threshold is $170,050 for single filers and $340,100 for joint filers.

Gather Accurate Income Information

Accurate income reporting is fundamental to ensure compliance. Gather all necessary documentation, including profit and loss statements, income statements, and relevant 1099 forms. Inaccurate income reporting can lead to errors in the QBI deduction calculation and potential penalties.

Separate Qualified and Non-Qualified Income

It is vital to distinguish between qualified and non-qualified income. Qualified income includes income from a trade or business, whereas non-qualified income encompasses wages, capital gains, and interest income. Only qualified business income is eligible for the QBI deduction, so proper classification is crucial.

Understand and Apply the QBI Deduction Limitations

The QBI deduction is subject to several limitations based on income level and business type. For high-income earners, the deduction may be limited or phased out. Additionally, certain specified service trades or businesses (SSTBs), such as health, law, and accounting, may face additional limitations. Familiarise yourself with these limitations and apply them correctly to avoid errors.

Keep Detailed Records and Documentation

Maintaining detailed records and documentation is essential for ensuring compliance and substantiating your QBI deduction. Keep copies of all relevant financial documents, including receipts, invoices, and contracts. Proper documentation will be invaluable if the IRS requests additional information or conducts an audit.

Utilise Professional Tax Software or Services

Tax software and professional tax services can significantly simplify the process of completing 8995 Form. These tools are designed to handle the complexities of tax laws and ensure accurate calculations. Consider investing in reputable tax software or consulting with a tax professional to ensure compliance.

Double-Check Your Calculations

Errors in calculations can lead to penalties and delays in processing your tax return. Double-check all figures, including your taxable income, qualified business income, and QBI deduction amount. Even small errors can have significant consequences, so take the time to review your calculations thoroughly.

Stay Updated with Tax Law Changes

Tax laws are subject to change, and staying informed about the latest updates is crucial for compliance. Subscribe to IRS newsletters, follow reputable tax news sources, and consult with tax professionals regularly. Being aware of changes in tax laws will help you accurately complete 8995 Form and avoid potential pitfalls.

File on Time and Pay Any Owed Taxes

Timely filing and payment of taxes are fundamental to avoiding penalties. Ensure you file Form 8995 by the IRS deadline, which is typically April 15th for most taxpayers. If you owe taxes, make sure to pay them by the due date to avoid interest and penalties.

Conclusion

Ensuring compliance and avoiding penalties when filing 8995 Form requires a thorough understanding of the form’s purpose, eligibility criteria, and limitations. By following these 10 tips—understanding the purpose, determining eligibility, gathering accurate information, separating income types, understanding limitations, keeping detailed records, using professional tools, double-checking calculations, staying updated with tax laws, and filing on time—you can navigate the complexities of the QBI deduction and minimise the risk of penalties. Remember, when in doubt, consult with a tax professional to ensure accurate and compliant filing.

FAQs

1. What is the purpose of IRS 8995 Form?

IRS 8995 Form is used to calculate and report the Qualified Business Income Deduction (QBI) under Section 199A. It allows eligible taxpayers to deduct up to 20% of their qualified business income, reducing their taxable income.

2. Who is eligible to file 8995 Form?

Eligible taxpayers include individuals, estates, and trusts with income from a qualified trade or business, such as sole proprietorships, partnerships, and S corporations. Taxable income must be below specific thresholds, which are adjusted annually.

3. What are the income thresholds for the QBI deduction in 2023?

For 2023, the QBI deduction income thresholds are $170,050 for single filers and $340,100 for joint filers. Taxpayers with income above these thresholds may face limitations or phase-outs on their QBI deduction.

4. What types of income are considered non-qualified for the QBI deduction?

Non-qualified income includes wages, capital gains, interest income, and dividends. Only income from a qualified trade or business is eligible for the QBI deduction.

5. How can I ensure my calculations on 8995 Form are accurate?

To ensure accurate calculations, double-check all figures, including taxable income, qualified business income, and the QBI deduction amount. Utilising professional tax software or consulting with a tax professional can also help ensure accuracy.

Also read: QUALITY OF EARNINGS REPORT: TOP 10 RED FLAGS TO WATCH FOR