1099-R Code 1:The IRS Form 1099-R reports distributions from pensions, annuities, retirement plans, IRAs, and insurance contracts. If you’ve taken an early distribution, you might find 1099-R Code 1 in Box 7 of your 1099-R form. Understanding what this means and how it affects your taxes is crucial to avoid potential penalties and ensure accurate reporting.

What is a 1099-R Form?

The 1099-R form is issued for distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. This form provides information to the IRS and the recipient about the distribution amount and the tax implications.

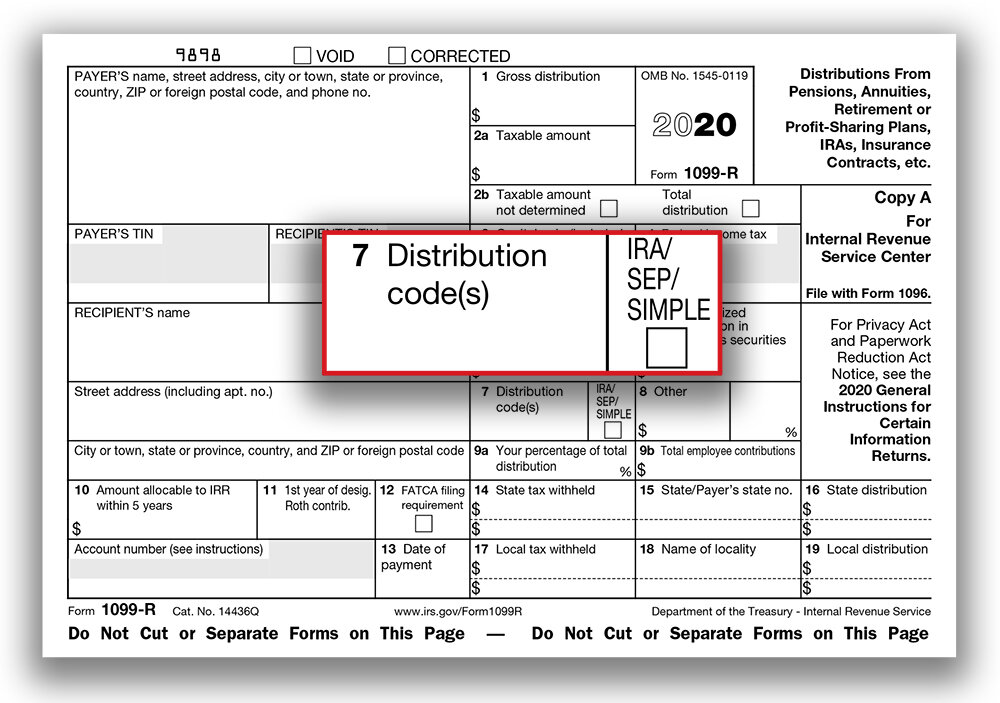

Breaking Down Box 7 of the 1099-R Form

Box 7 of the 1099-R form contains a distribution code that identifies the type of distribution made. These codes range from normal distributions to early distributions and rollovers. 1099 R Code 1 in Box 7 specifically indicates an early distribution where the taxpayer is under the age of 59½ and no known exception applies.

What Does 1099-R Code 1 Mean?

1099 R Code 1 in Box 7 of your 1099-R form signifies an early distribution with no known exception. This typically means that the amount distributed is subject to a 10% early withdrawal penalty in addition to regular income tax.

Tax Implications of Early Distributions

Early distributions are included in your taxable income for the year. This means you’ll pay income tax on the amount distributed at your regular tax rate. In addition, the IRS imposes a 10% penalty on early withdrawals to discourage the use of retirement funds before retirement age.

How to Report 1099 R Code 1 Early Distributions on Your Tax Return

When filing your tax return, you’ll need to report the early distribution amount from your 1099-R form on Form 1040. The 10% penalty is calculated and reported on Form 5329, which is then included in your overall tax liability.

Exceptions to the 1099 R Code 1 Early Withdrawal Penalty

There are specific circumstances under which the 10% early withdrawal penalty may not apply, such as:

- Distributions made after the death of the account owner

- Distributions made due to total and permanent disability

- Distributions made as part of a series of substantially equal periodic payments

- Distributions used to pay for qualified higher education expenses

- Distributions used to buy, build, or rebuild a first home (up to a $10,000 lifetime limit)

If any of these exceptions apply, you’ll need to file Form 5329 to claim the exception and avoid the 10% penalty.

Potential Penalties and Interest for 1099 R Code 1

Failing to report an early distribution accurately can result in penalties and interest from the IRS. If the 10% penalty is not paid when due, it can accrue interest, increasing your overall tax liability. It’s essential to understand and correctly report these distributions to avoid additional costs.

Strategies to Minimize the Impact of 1099 R Code 1 Early Distributions

To minimize the impact of early distributions, consider the following strategies:

- Avoid taking early distributions unless absolutely necessary.

- Explore other sources of funds before tapping into retirement accounts.

- If you must take a distribution, ensure you understand the potential penalties and tax implications.

- Consult with a tax professional to explore all possible exceptions and reporting requirements.

Planning for the Future to Avoid 1099 R Code 1

Proper planning can help you avoid the need for early distributions. Contribute regularly to your retirement accounts and consider other savings options for emergencies. Building a financial cushion outside of your retirement accounts can provide flexibility without incurring penalties.

Seeking Professional Help for 1099 R Code 1

If you’re unsure about the tax implications of an early distribution or how to report it, seeking help from a tax professional can be invaluable. They can provide guidance specific to your situation and help ensure compliance with IRS regulations.

Conclusion

Understanding the implications of 1099-R Code 1 on your 1099-R form is crucial for accurate tax reporting and avoiding unnecessary penalties. Early distributions can significantly impact your tax liability, so it’s essential to be well-informed and consider all potential exceptions and strategies to mitigate their effects. Proper planning and professional guidance can help you navigate these complexities and make informed financial decisions.

FAQs

1. What is 1099-R Code 1 on a 1099-R form?

1099-R Code 1 on a 1099-R form indicates an early distribution from a retirement account where the taxpayer is under the age of 59½, and no known exception to the early withdrawal penalty applies.

2. How do I report a 1099 R Code 1 early distribution on my tax return?

Report the early distribution amount on Form 1040 and calculate the 10% penalty using Form 5329. Include both forms when filing your tax return.

3. Are there any exceptions to the 1099 R Code 1 10% early withdrawal penalty?

Yes, exceptions include distributions due to death, disability, a series of substantially equal periodic payments, higher education expenses, and first-time home purchases, among others.

4. What happens if I don’t report a 1099 R Code 1 early distribution correctly?

Failing to report an early distribution correctly can result in penalties and interest from the IRS, increasing your overall tax liability.

5. How can I avoid the 1099 R Code 1 10% early withdrawal penalty?

Avoiding the penalty involves understanding and applying for exceptions where applicable and planning your finances to minimize the need for early distributions. Seeking advice from a tax professional can also help you navigate these rules effectively.

Also : OUTSOURCED FINANCE AND ACCOUNTING: 10 KEY BENEFITS FOR YOUR BUSINESS